For a deeper dive into the LayerZero ecosystem and more opportunities join our Forum.

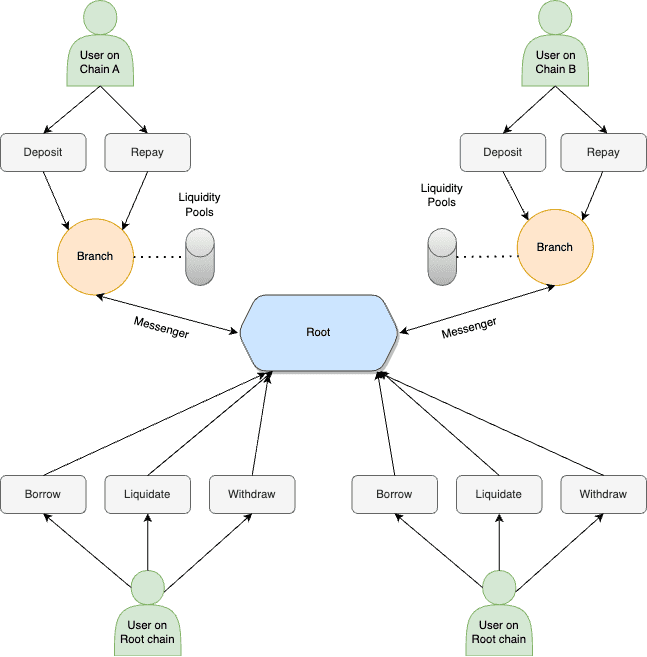

Cedro Finance is a cross-chain decentralized liquidity protocol where users can lend and borrow the listed assets across multiple chains with affordable transaction fees. Lenders are able to deposit their assets to contribute to the liquidity of the platform and borrowers are able to borrow the liquidity in an overcollateralized manner.

One of the major goals of Cedro Finance is to act as a cross-chain Liquidity Layer over time. Builders will be able to use Cedro's Liquidity and codebase to build their applications without having to worry about liquidity on their platform. A few out of the many applications that can be built using Cedro as the infrastructure are:

In the world of multiple isolated blockchains, projects that are looking to expand have no other option than to issue their token separately across multiple isolated chains. For example, UNI is deployed on multiple chains, which means it’ll have a liquidity pool on each chain with no interconnection. This fractures the already fractured liquidity and reduces capital efficiency. This problem is tackled by Cedro Unified Liquidity Token. It is a novel feature developed by Cedro.

CULT lets users deposit multi-chain assets (ex. USDT, UNI, etc.) from different chains and add them to a unified liquidity pool. For example, when a lender deposits 100 USDC in Ethereum and 200 USDC in Solana, they’ll receive 300 ceUSDC on the Root chain and receive interest on them. Because of the unified liquidity pool, the capital will be concentrated in a single pool and the efficiency will be maximal. The interest rate will be the same across all the chains for multi-chain assets. On top of that, users can borrow the asset on any supported chain which makes multi-chain assets truly chain agnostic.

The Liquidity Pools aren't literally merged though. Cedro is virtually able to merge the pools since all the global state variables are stored in the Root. For the merging, they introduce two additional parameters: Global Liquidity Factor (GLF) and Asset Colleration Factor (ASF).